In today’s digital economy, businesses and individuals have numerous options for processing payments beyond PayPal.

This my personal analysis on wolfcasinoguide.com compares major payment platforms across key metrics including fees, features, geographical availability, and integration capabilities.

Table of Contents

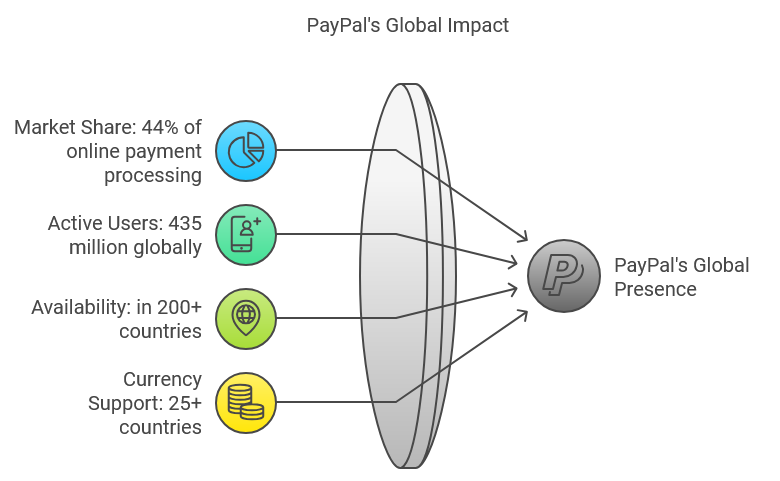

PayPal

Overview

- Market Share: 44% of online payment processing (2023)

- Active Users: 435 million globally

- Available in: 200+ countries

- Currencies supported: 25+

Pros

- Universal recognition and trust

- Extensive buyer/seller protection

- Quick setup process

- No monthly fees for standard accounts

- Supports multiple payment methods (credit cards, bank transfers)

- Built-in invoicing system

Cons

- Higher transaction fees (2.9% + $0.30 per transaction)

- Account freezes reported frequently

- Customer service often criticized

- Currency conversion fees (4-5%)

- Complex fee structure for international transactions

I created article an article Top PayPal Casinos, maybe it would be useful and interesting for you too. The theme of article is very related.

Stripe

Overview

- Market Share: 19% of online payment processing

- Processing Volume: $640 billion (2023)

- Available in: 47 countries

- Currencies supported: 135+

Pros

- Developer-friendly with extensive API documentation

- Highly customizable checkout experience

- Advanced fraud protection

- Transparent pricing structure

- Better API uptime (99.99%)

- Supports subscription billing

- Modern dashboard and reporting tools

Cons

- More complex setup requiring technical knowledge

- Limited direct consumer-facing features

- Higher fees for international cards (additional 1%)

- No built-in marketplace for sellers

Venmo (owned by PayPal)

Overview

- Active Users: 90 million (US only)

- Transaction Volume: $230 billion annually

- Available in: United States only

- Primary demographic: Millennials and Gen Z

Pros

- Free person-to-person transfers using balance/bank account

- Social features popular with younger users

- Simple, intuitive interface

- Instant transfers available

- Business profiles available with 1.9% + $0.10 fee

Cons

- US-only availability

- Limited business features

- No international transfers

- Privacy concerns with social feed

- Limited customer support

Square

Overview

- Market Share: 14% of payment processing

- Processing Volume: $200 billion annually

- Available in: 8 countries

- Focus on small-medium businesses

Pros

- All-in-one business solution

- Competitive in-person payment rates (2.6% + $0.10)

- Free POS software

- Instant deposits available

- Integrated inventory management

- Built-in analytics and reporting

Cons

- Limited international availability

- Higher online payment fees (2.9% + $0.30)

- Account stability issues reported

- Less suitable for large enterprises

- Limited customization compared to Stripe

Wise (formerly TransferWise)

Overview

- Active Users: 16 million

- Processing Volume: $104 billion annually

- Available in: 170+ countries

- Specializes in international transfers

Pros

- Lowest international transfer fees

- Real mid-market exchange rates

- Transparent fee structure

- Multi-currency accounts available

- Business API available

- Excellent mobile app

Cons

- Not designed for in-person payments

- Limited point-of-sale features

- No built-in shopping cart integration

- No credit card processing

- Slower transfer times for some currencies

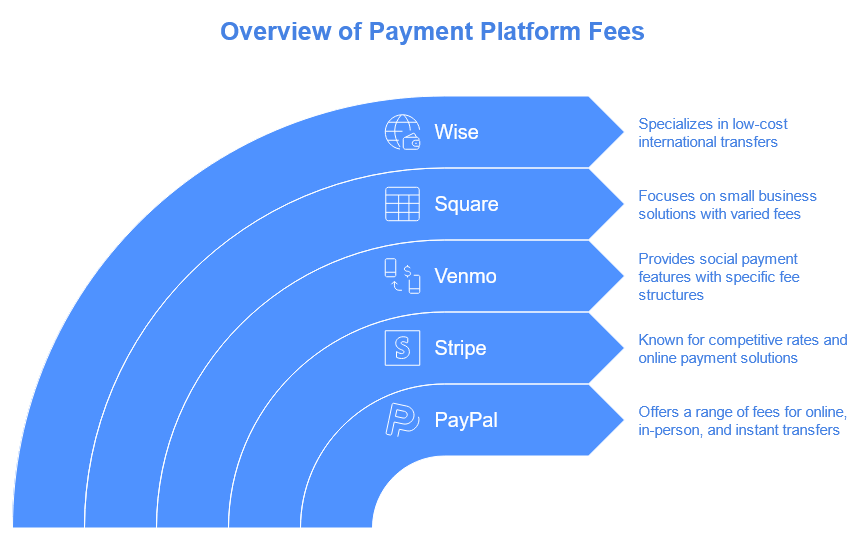

Fee Comparison (US Domestic Transactions)

| Platform | Online Payment | In-Person | Instant Transfer | Monthly Fee |

|---|---|---|---|---|

| PayPal | 2.9% + $0.30 | 2.7% + $0.30 | 1.5% | $0 |

| Stripe | 2.9% + $0.30 | 2.7% + $0.05 | 1% | $0 |

| Venmo | 1.9% + $0.10 | N/A | 1.75% | $0 |

| Square | 2.9% + $0.30 | 2.6% + $0.10 | 1.5% | $0 |

| Wise | 0.4-0.7% | N/A | $0 | $0 |

Platform Selection Guidelines

Best for E-commerce

- Small businesses: Square or PayPal

- Large enterprises: Stripe

- International focus: Wise + Stripe combination

Best for In-Person Sales

- Small retailers: Square

- Mobile businesses: PayPal Here or Square

- Large retailers: Stripe Terminal

Best for International Business

- Currency conversion: Wise

- Global e-commerce: Stripe

- Marketplace platforms: PayPal

Best for Personal Use

- US domestic: Venmo

- International transfers: Wise

- Universal acceptance: PayPal

Security and Compliance

All platforms discussed maintain PCI DSS compliance and employ industry-standard encryption. However, they differ in additional security features:

- Stripe: Most comprehensive fraud detection tools

- PayPal: Strongest buyer/seller protection

- Square: Advanced dispute management

- Wise: Regular regulatory audits

- Venmo: Two-factor authentication but limited fraud protection

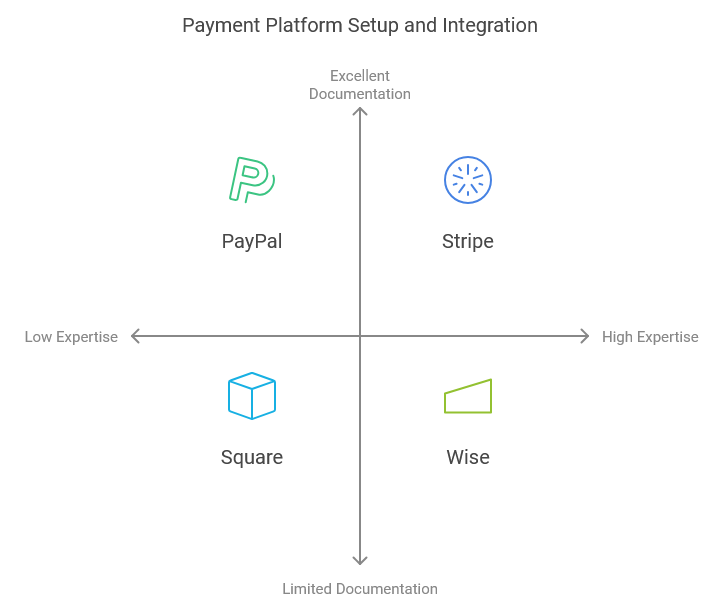

Integration Complexity

| Platform | Setup Time | Technical Expertise Required | API Documentation |

|---|---|---|---|

| PayPal | 1-2 hours | Low | Good |

| Stripe | 2-5 days | High | Excellent |

| Square | 1-3 hours | Medium | Good |

| Wise | 1-2 days | Medium | Good |

| Venmo | 1 hour | Low | Limited |

Conclusion

While PayPal remains the most widely recognized payment platform, alternatives offer compelling advantages for specific use cases. Stripe excels in customization and developer tools, Square provides excellent in-person solutions, Wise leads in international transfers, and Venmo dominates US peer-to-peer payments.

Personally I like Paypal the most. But Stripe and Wise are also great alternatives.

The best choice depends on specific business needs, technical capabilities, and target market location.