What is Entain?

Entain plc is one of the world’s largest sports betting and gaming companies, operating in both online and retail sectors.

Established in 2004 (previously known as GVC Holdings), the company has grown into a leading global player in the gambling industry. Entain operates a diverse portfolio of well-known brands across sports betting, online gaming, and casino services.

- Established: Entain (formerly GVC Holdings) was founded in 2004.

- Employees: Entain has approximately 31,000 employees globally.

- Brands: Entain operates over 30 brands across its global portfolio.

Key Brands:

- Ladbrokes: A leading sports betting and gambling company in the U.K.

- Coral: One of the most recognized retail and online gambling brands in the U.K.

- Bwin: A European online betting platform that offers sports betting, poker, and casino games.

- PartyCasino: An online casino platform offering a wide range of casino games.

- BetMGM: A joint venture with MGM Resorts in the U.S. aimed at capturing the growing sports betting market in North America.

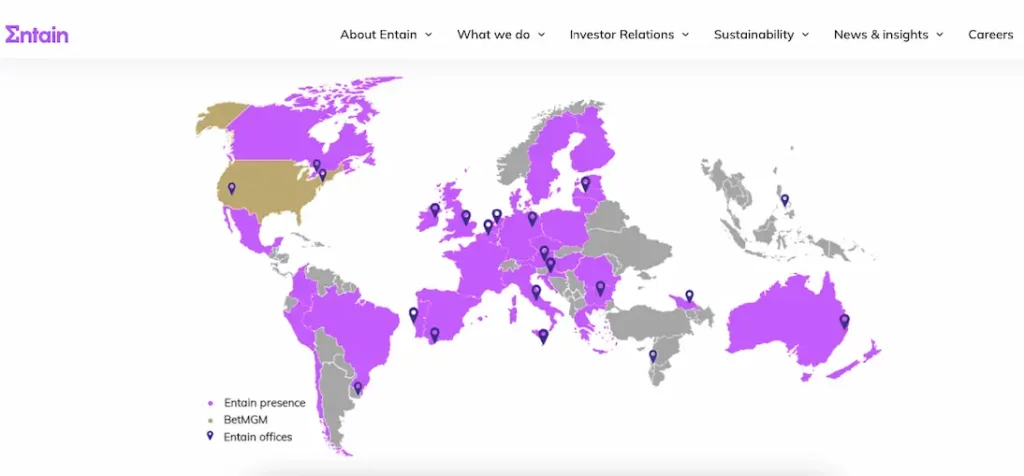

Market Reach:

Entain has a strong presence in Europe, Australia, and the U.S., with its BetMGM venture capitalizing on the rapidly expanding U.S. market for sports betting.

The company is operational in over 20 countries, with licenses to operate in major markets worldwide, including strong regulatory jurisdictions in Europe and Australia.

What is the Entain Controversy?

Entain has faced some controversies related to regulatory scrutiny and fines, particularly regarding compliance with responsible gambling practices and anti-money laundering (AML) regulations.

In 2022, the company was fined £17 million by the U.K. Gambling Commission for social responsibility and AML failures in its Ladbrokes and Coral brands.

This was one of the largest fines ever imposed by the commission and raised concerns about the company’s practices in customer protection and risk management.

You can read more about this fine on BBC.com article.

Entain has since pledged to improve its operations and has implemented more stringent policies on customer safety, responsible gambling, and compliance to ensure it meets regulatory standards in all jurisdictions.

Related article: Overview of Flutter Entertainment

What is the Meaning of the Word “Entain”?

The word “Entain” was chosen during the company’s rebranding from GVC Holdings in 2020. It is intended to reflect the company’s vision of “entertainment in all aspects of gambling.”

The name change also symbolized Entain’s commitment to responsible gaming, focusing on providing entertainment while ensuring player protection.

What Does Entain Do?

Entain operates as a global sports betting, gaming, and entertainment provider, offering a wide variety of gambling products across different platforms:

- Sports Betting: Entain’s portfolio includes both online and retail sports betting brands such as Ladbrokes, Coral, and Bwin.

- Casino Gaming: Through its online casino brands like PartyCasino and Ladbrokes Casino, Entain offers a wide selection of digital slot machines, table games, and live casino experiences.

- Poker and Online Gaming: The company runs multiple online poker platforms and other gaming ventures, including PartyPoker.

- U.S. Expansion: Through its joint venture BetMGM, Entain is rapidly growing in the North American market, taking advantage of the legalization of sports betting in multiple U.S. states.

Why Are Entain Shares Falling?

Entain shares have experienced periods of volatility, influenced by several factors:

- Regulatory Scrutiny: The company’s regulatory issues, particularly the £17 million fine in the U.K., have weighed on investor confidence.

- Market Conditions: Broader macroeconomic concerns, including inflation, recession fears, and changing consumer behavior in the gambling industry, have impacted Entain’s stock performance.

- Takeover Uncertainty: In 2021, Entain was involved in takeover discussions with MGM Resorts, and the failure of the deal left some investors uncertain about the company’s future growth prospects.

- Competitor Growth: The highly competitive nature of the sports betting market, particularly in the U.S., means that Entain faces pressure from other major players like DraftKings, FanDuel, and Caesars.

However, stock performance can be influenced by various factors and might not necessarily reflect the long-term fundamentals of the business.

Should I Sell Entain Shares?

Whether or not to sell Entain shares depends on your personal investment goals, risk tolerance, and market outlook.

While Entain has faced short-term challenges, the company remains a major player in the global sports betting and gaming sector.

It continues to expand in key growth markets such as the U.S., which offers significant long-term potential through its BetMGM partnership.

Here are the key points from Entain’s 2023 Annual Report:

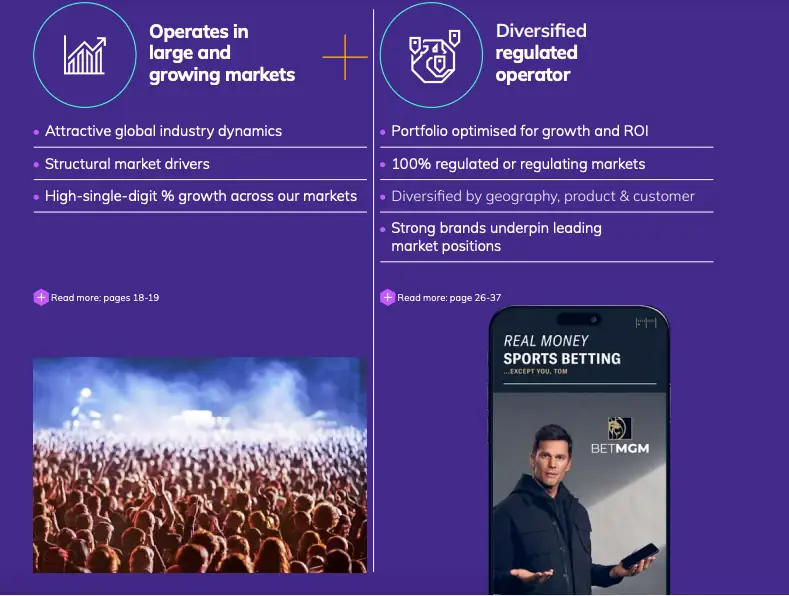

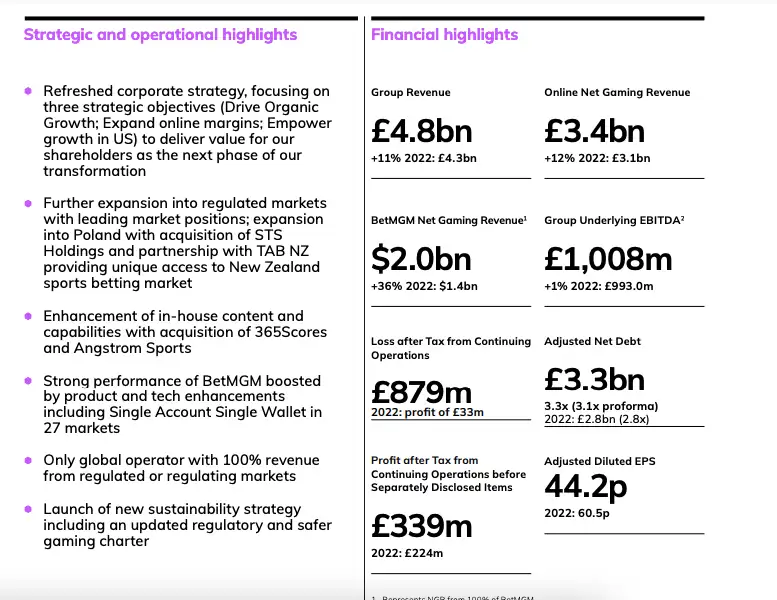

1. Strategic Transformation

- Entain refined its strategy with three main objectives: driving organic growth, expanding margins, and gaining market share in the U.S..

- Focus on regulated markets; they exited from unregulated ones, losing £100 million in EBITDA from 140+ unregulated markets.

- Expansion into Poland (through the acquisition of STS Holdings) and a partnership with TAB NZ in New Zealand.

2. Acquisitions and Technology Enhancements

- Acquisition of 365Scores to improve customer experience and expand content.

- Angstrom Sports was acquired to enhance U.S. sports betting with improved data analytics and pricing capabilities.

- BetMGM, a joint venture, performed well, reaching $2 billion in revenue (+36%) and profitability in H2 of 2023.

3. Sustainability and Player Protection

- Launched a new sustainability strategy with a focus on responsible gaming and a Net Zero carbon target by 2035.

- Advanced Responsibility and Care (ARC) program rolled out in 22 jurisdictions, improving player safety.

4. Financial Highlights

- Group Revenue: £4.8 billion (+11% YoY).

- Online Net Gaming Revenue: £3.4 billion (+12% YoY).

- Underlying EBITDA: £1.008 billion, a 1% increase.

- Loss of £879 million after tax, compared to a profit of £33 million in 2022, largely due to regulatory challenges.

5. Challenges and Market Outlook

- Regulatory pressures in major markets, especially the UK, impacted organic performance.

- The company continues to invest in improving operational efficiency (Project Romer).

- BetMGM is expected to deliver $500 million in EBITDA by 2026 as the U.S. market continues to grow.

6. Leadership and Governance

- Stella David served as interim CEO in 2023, succeeding Jette Nygaard-Andersen.

- The company has a strong focus on ESG, with enhanced board oversight and governance reforms.

7. Employee and Community Initiatives

- Strong employee engagement, with a focus on Diversity, Equity, and Inclusion (DE&I) through new networks like Black Professionals@Entain.

- Commitment to communities through the Entain Foundation, with £100 million pledged over five years to various causes.

These points capture the main achievements and strategic moves of Entain in 2023 as they continue to solidify their global presence in the regulated betting and gaming industry.

You can read this report by yourself in the link (of course it has more than 200 pages).

Investors who believe in the long-term growth of online gambling and sports betting may choose to hold, while those looking for short-term gains may consider selling depending on market conditions.

Always consult with a financial advisor before making investment decisions.

Who is the CEO of Entain?

As of September 2024, Gavin Isaacs was appointed as CEO of Entain, taking over from interim CEO Stella David. Isaacs has over 25 years of experience in the global betting, gaming, and lottery industries.

He has previously held leadership roles at Scientific Games, SBTech, and other major gaming companies. His expertise in technology and strategic leadership is expected to drive Entain’s next phase of growth and development in both established and emerging markets.

Welcome to Entain, Gavin! 👋

— Entain (@EntainGroup) September 2, 2024

Joining the Entain Team today, Gavin brings 25+ years’ experience at some of the largest operators in the industry and a place in The AGA’s Hall of Fame.

Find out more information in Gavin’s announcement below 👇https://t.co/PYpm2ESvR3 pic.twitter.com/E5qVjq47zh

Stella David, Interim CEO & Chair Designate, said: “I am looking forward to working with Gavin and transitioning into my new role as Chair of this fantastic business. The positive progress we have already achieved means the business has strong building blocks in place for the future. I am confident that with Gavin’s leadership we will realise the ambitious plans that we have for Entain.”

Entain plc Chairman Barry Gibson to retire, Stella David to succeed

— DirectorsTalk (@DirectorsTalk) April 4, 2024

Stella is currently interim CEO

Read More: https://t.co/ErsfXKZKIp#ENT #RNS #Stocks #Entain #SportsBetting #Gaming #iGaming #BetMGM #FTSE100 #Investing pic.twitter.com/dN2lhrQlNv

Jette Nygaard-Andersen earlier was the CEO of Entain and was out due to bribary scandal.

💸 Entain Boss Out Following £615m Bribery Scandal

— HighstakesDB (@highstakesdb) December 18, 2023

👩 Jette Nygaard-Andersen, the CEO of Entain, the parent company of Coral and Ladbrokes, has resigned with immediate effect.https://t.co/u9RXcXMe4W#HSDB #News #Casino #Poker #Gambling #Scandal pic.twitter.com/1C9UccNXeA

Nygaard-Andersen has played a key role in the company’s expansion into new markets and its efforts in promoting responsible gambling.

Is Entain a PLC?

Yes, Entain is a Public Limited Company (PLC). It is listed on the London Stock Exchange (LSE) under the ticker symbol ENT and is a constituent of the FTSE 100 Index, which includes the largest companies listed on the LSE by market capitalization.

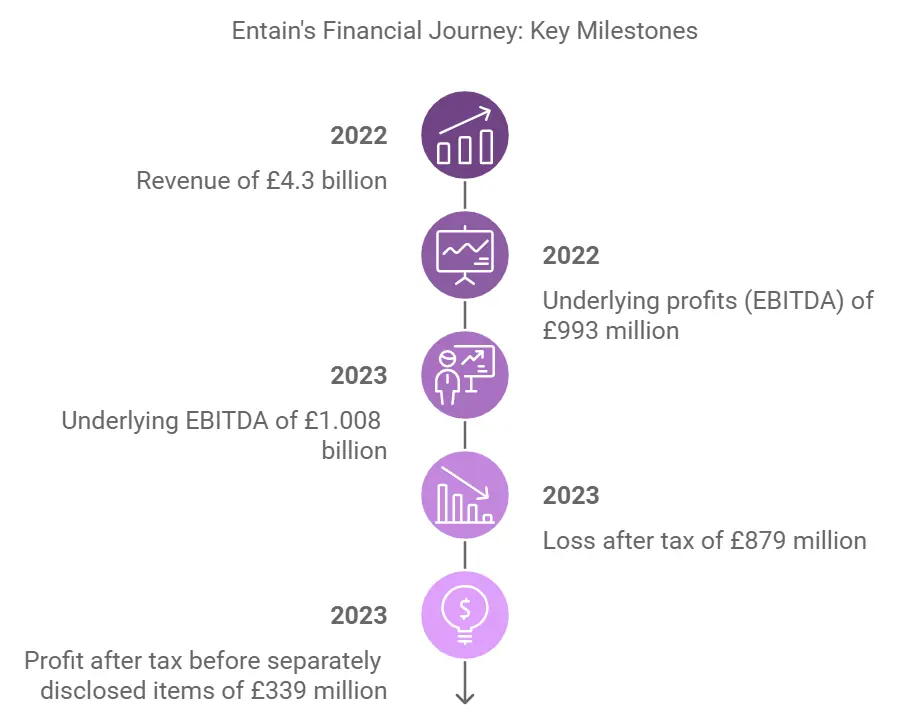

How Much Profit Does Entain Make?

Entain’s profitability has grown significantly over the years, driven by its diversified portfolio and expansion into the U.S. In 2022, the company reported a revenue of approximately £4.3 billion, with underlying profits (EBITDA) of £993 million.

According to Entain’s 2023 Annual Report, the company’s underlying EBITDA (earnings before interest, tax, depreciation, and amortization) for 2023 was £1.008 billion, a 1% increase from 2022.

However, Entain reported a loss after tax of £879 million from continuing operations, compared to a profit of £33 million in 2022. This loss was largely attributed to regulatory challenges and market exits as part of their strategic shift to focus on regulated markets.

Despite the overall loss, Entain’s profit after tax before separately disclosed items was £339 million, which is a significant increase from £224 million in 2022

Entain’s profitability is also supported by its strong presence in highly regulated and mature markets like Europe and Australia, where it has a well-established customer base.

According to Entain’s 2023 Annual Report, the most profitable brand is BetMGM, a joint venture between Entain and MGM Resorts.

BetMGM recorded a Net Gaming Revenue (NGR) of $1.96 billion in 2023, marking a growth of 36% compared to the previous year.

This brand also achieved profitability over the last three quarters of the year, making it a significant contributor to Entain’s success in the U.S. market.

Risks of the company

The main risks for Entain as highlighted in the 2023 Annual Report include:

- Regulatory and Compliance Risk: Entain faces challenges in keeping up with varying legal and regulatory requirements across its diverse markets, especially as regulations evolve. The risk includes failure to comply with anti-money laundering (AML) legislation, data privacy laws, and changes in tax regulations.

- Cybersecurity Risk: As a digital business, Entain is vulnerable to cyberattacks, which could compromise its systems, data security, and overall operational integrity. A failure in this area could lead to significant financial and reputational damage.

- Taxation Risk: Entain operates in multiple jurisdictions, each with its own complex tax regimes. Changes in tax laws or enforcement actions could have material financial implications for the company.

- Third-Party Supplier Risk: Entain is heavily reliant on third-party suppliers, especially for technology and other key operational functions. Any failure from these suppliers, including financial instability or service delivery issues, could impact Entain’s ability to deliver its services effectively.

- Technological Resilience: Maintaining the stability and resilience of its technology platforms is crucial for Entain’s operations, particularly as it seeks to expand its presence in new markets.

- Trading and Liability Risk: Entain must accurately manage its betting and gaming liabilities, as failure to do so can lead to significant losses.

These risks, if not properly managed, could severely affect the company’s financial performance, reputation, and long-term growth strategy

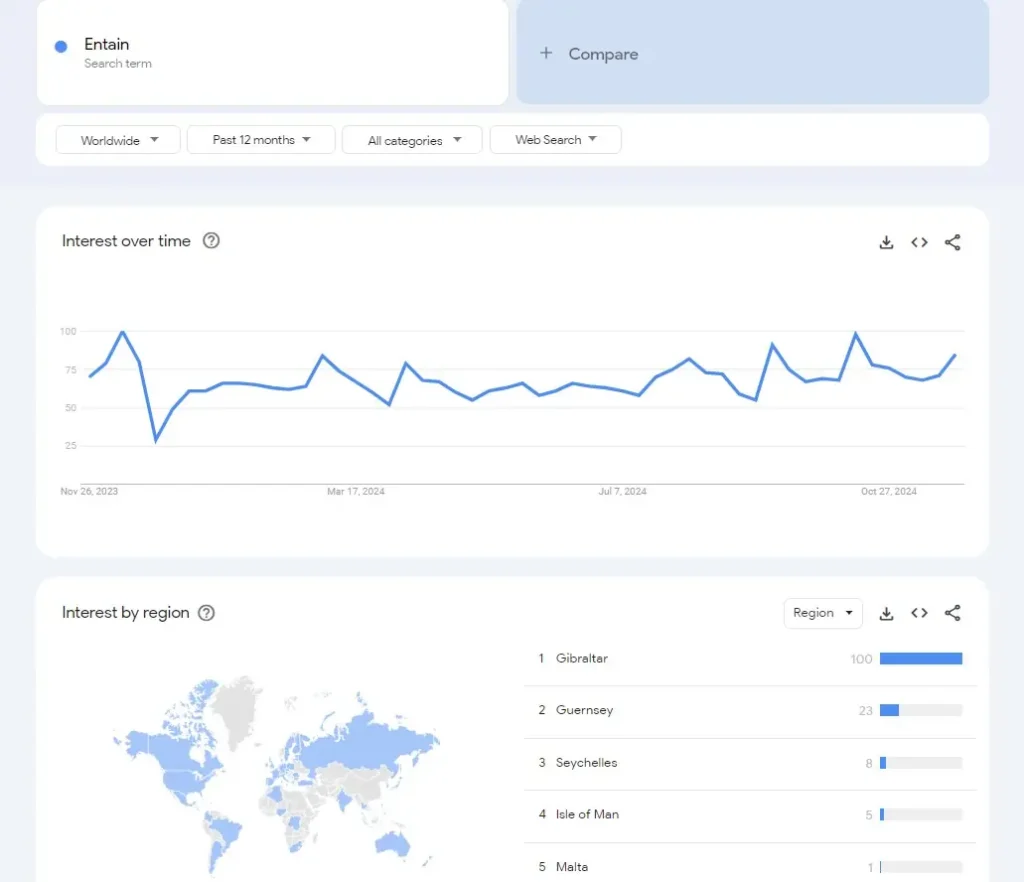

People are searching for Entain accordig Google trends. But there are no major spikes at the time. Interesting, that most searches comes from Gibraltar country.

Conclusion

Entain is one of the largest and most diverse gambling companies in the world, with a significant presence in both retail and online markets.

While the company has faced regulatory challenges and market volatility, it remains a leader in the sports betting and gaming industry.

Its continued focus on innovation, responsible gambling, and expansion into high-growth markets such as the U.S. position it well for future growth.

I hope you liked this article on wolfcasinoguide.com, if so please share it on social media.

One Response

Very informative article. My cousin worked at Entain, he liked it a lot. Like the informative of review.