How to stop gambling until you not lose all your money?

Gambling addiction can be a challenging issue to overcome, but with determination and the right strategies, it is possible to regain control over your life.

Recognizing the need for help is the first critical step towards recovery. This article on , “How to Stop Gambling,” provides a comprehensive guide to overcoming this addiction, offering practical strategies and expert advice to support you on your journey to reclaim control over your life and finances.

Here are ten detailed and specific ideas to help you stop gambling, along with real-life examples to illustrate each point.

Table of Contents

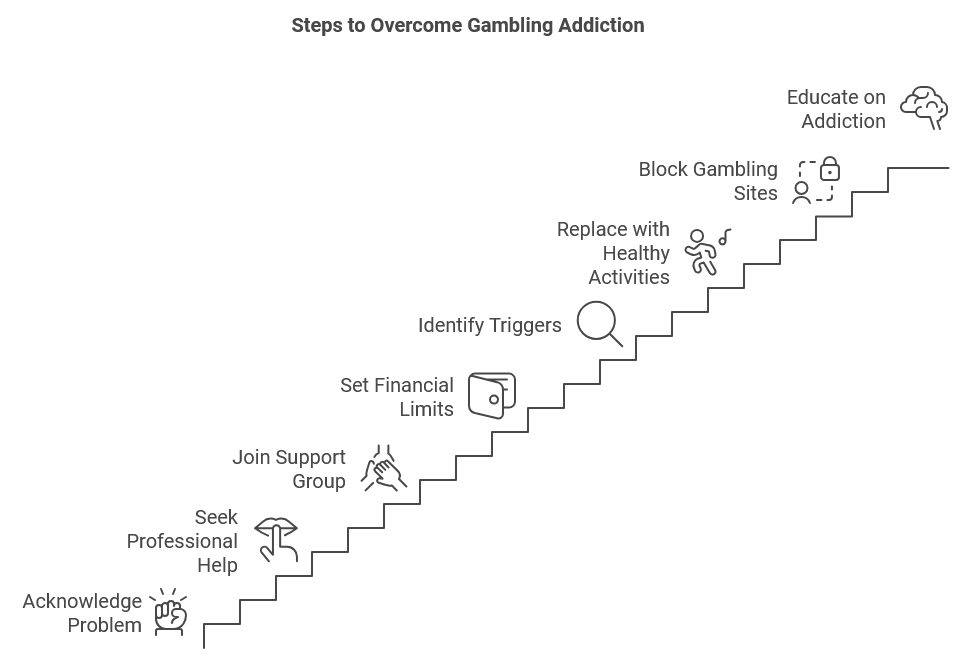

1. Acknowledge the Problem

The first step in overcoming gambling addiction is admitting that you have a problem. Recognize the negative impact gambling has on your life and commit to making a change. This means accepting that gambling is not just a harmless pastime but a harmful habit that affects your finances, relationships, and mental health.

Only 8% of people with gambling addiction ever seek help, so recognizing the issue is crucial.

Gambling addiction can lead to severe consequences, with 30% of problem gamblers in the UK saying they had attempted suicide before entering treatment

2. Seek Professional Help

Consulting with a mental health professional who specializes in addiction can provide the guidance and support you need. Therapists, counselors, and support groups can help you understand the root causes of your gambling addiction and develop strategies to overcome it.

Cognitive behavioral therapy (CBT) is a common approach, with 60% of problem gamblers reporting that they have gambled less often after receiving CBT

3. Join a Support Group

Support groups like Gamblers Anonymous (GA) offer a community of individuals who share similar experiences. Sharing your struggles and successes with others can provide emotional support and accountability.

Gambling addiction is very treatable once it has been identified, but only around 8% of those affected will ever seek help.

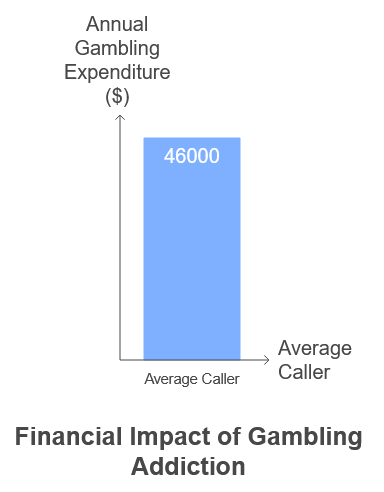

4. Set Financial Limits

Take control of your finances by setting strict limits on your spending. Consider handing over control of your finances to a trusted family member or friend to help you avoid the temptation to gamble.

The average caller of the California gambling hotline spent $46,000 annually on gambling. By setting limits and sticking to them, you can prevent further financial damage.

5. Identify Triggers

Identify the situations, emotions, or environments that trigger your urge to gamble. Once you know your triggers, you can develop strategies to avoid or cope with them effectively.

50.2% of all slot machine players have gambling problems, so avoiding these triggers is crucial.

6. Replace Gambling with Healthy Activities

Find alternative activities to fill the time and emotional void left by gambling. Engage in hobbies, exercise, spend time with loved ones, or take up new interests to distract yourself from gambling.

Finding healthy alternatives to gambling can help fill the void and provide a sense of fulfillment. 60% of problem gamblers smoke, and 26% are alcoholics, so replacing gambling with healthier habits is essential.

7. Block Access to Gambling Sites

Use technology to your advantage by installing website blockers and self-exclusion tools on your devices. Many online gambling sites offer self-exclusion options to help you stay away.

Example: Tom installed gambling blocking software on his computer and phone. He also registered with a national self-exclusion program that prevented him from accessing any online gambling sites.

8. Create a Strong Support System

Surround yourself with supportive friends and family who understand your struggle and are willing to help you stay on track. Open communication with your support system can provide encouragement and accountability.

Suicide rates among problem gamblers are 15x higher than the general population, so having a support system is crucial.

9. Educate Yourself About Gambling Addiction

Learn about the nature of gambling addiction, its causes, and its effects on your brain and behavior. Understanding the science behind addiction can empower you to make informed decisions and resist urges.

Gambling addiction is a recognized mental health diagnosis, and it’s important to educate yourself about the condition.

How to Stop Gambling: 10 Effective Strategies

- Admit the Problem: Acknowledge that you have a gambling problem and understand its impact on your life.

- Seek Professional Help: Consult with therapists or counselors who specialize in gambling addiction.

- Join Support Groups: Engage with support groups like Gamblers Anonymous for communal support and accountability.

- Avoid Temptation: Stay away from places and activities where gambling occurs.

- Keep Busy: Engage in hobbies and activities that don’t involve gambling to fill your time productively.

- Educate Yourself: Learn about the risks and the psychology of gambling to understand its negative impact better.

- Practice Self-Care: Focus on your physical and emotional well-being through exercise, healthy eating, and mindfulness practices.

- Build a Support Network: Surround yourself with friends and family who support your goal of quitting gambling.

- Consider Medication: In some cases, medication may be prescribed to help with the psychological aspects of addiction.

- Set Financial Limits: Implement strict financial controls to limit your access to money and reduce the risk of gambling.

You may also like: How Old Do You Have to Be to Gamble?

Set Financial Limits: detailed explanation

1. Create a Budget:

- Track Your Spending: Begin by recording all your income and expenses to understand your financial situation fully.

- Allocate Funds: Assign specific amounts for necessities like rent, groceries, utilities, and savings.

- Set Limits on Discretionary Spending: Determine how much you can afford to spend on non-essential items and stick to these limits.

2. Restrict Access to Funds:

- Use Separate Accounts: Keep a separate account for your discretionary spending with limited funds, separate from your main account.

- Limit Cash Access: Carry only a small amount of cash and avoid using credit cards to reduce impulsive spending.

- Automatic Transfers: Set up automatic transfers to savings accounts or investments to safeguard your money from being gambled away.

3. Seek Help from a Financial Advisor:

- Professional Guidance: A financial advisor can help you create a realistic budget and provide strategies to manage your money effectively.

- Debt Management: If you have accumulated gambling-related debt, an advisor can assist in negotiating with creditors and creating a repayment plan.

4. Implement Controls with Loved Ones:

- Account Monitoring: Allow a trusted family member or friend to monitor your bank accounts and financial transactions.

- Joint Accounts: Consider having joint accounts where a co-signer must approve withdrawals, adding an extra layer of accountability.

5. Use Financial Tools:

- Spending Trackers: Utilize apps and tools that track your spending and alert you when you approach your limits.

- Prepaid Cards: Use prepaid cards for discretionary spending, which prevents you from spending more than the loaded amount.

6. Self-Exclusion from Gambling Sites:

- Block Access: Use software or services that block access to online gambling sites and casinos.

- Self-Ban Programs: Enroll in self-exclusion programs offered by gambling establishments, which prevent you from entering and participating.

7. Establish Clear Financial Goals:

- Short-term Goals: Set achievable short-term financial goals, such as saving a specific amount each month.

- Long-term Goals: Plan for long-term objectives like buying a house, retirement savings, or funding education, and use these goals as motivation to avoid gambling.

8. Regular Financial Reviews:

- Monthly Reviews: Regularly review your finances to ensure you are sticking to your budget and adjusting as necessary.

- Accountability Meetings: Schedule regular meetings with a trusted person to review your financial status and progress.

By setting and adhering to strict financial limits, you can significantly reduce the risk of falling back into gambling habits and work towards financial stability and recovery.

Related article: Is Gambling a Sin?

Statistics on gambling and losing money:

High Loss Rates:

- Casinos: On average, the house edge in a casino can range from 0.5% to 15% depending on the game, meaning that for every dollar gambled, players are statistically likely to lose between 0.5 and 15 cents over the long term.

Financial Impact:

- Problem Gamblers: It is estimated that problem gamblers lose on average between $10,000 and $15,000 per year due to their gambling habits

Debt Accumulation:

- Gambling Debts: Approximately 23% of problem gamblers report debts exceeding $20,000, and about 8% have debts over $50,000.

Bankruptcy Rates:

- Bankruptcy: Studies have shown that 20% of individuals who file for bankruptcy report gambling as a significant factor contributing to their financial problems.

Economic Costs:

- Societal Costs: The economic cost of problem gambling to society, including healthcare expenses, lost productivity, and criminal justice costs, is estimated to be around $6 billion annually in the United States alone.

These statistics highlight the substantial financial risks and broader economic impact associated with gambling, emphasizing the importance of awareness and intervention to mitigate these negative consequences.

Conclusion

Overcoming gambling addiction is a challenging journey, but it is possible with commitment, support, and the right strategies.

By acknowledging the problem, seeking professional help, and implementing effective techniques, you can regain control of your life and break free from the cycle of gambling.

By following the steps outlined in this article, “How to Stop Gambling” you can take significant strides toward breaking free from the cycle of addiction. Remember, recovery is a journey, and seeking help from professionals, support groups, and loved ones can make all the difference.

Your determination to stop gambling is the first and most crucial step towards a healthier, happier future.